Know What You Hold

Why it is so necessary to know about market cycles and how owning deflationary assets can liberate anyone from the enslavement system we are living in.

Buenos Diaz!

4/3/2024

Regarding the downturn in the cryptocurrency markets over the past few days and key points to consider when in doubt about asset accumulation or holdings.

The current sell pressure is certainly temporary barring another terrible manufactured “event” such as the engineered bridge collapse in Maryland, and simply a healthy pullback.

Nothing has changed fundamentally. The entire world, for better or worse is going more digital and the utilization of block chain technology is being rapidly adopted by the largest institutions in the world. This adoption rate has actually been increasing year after year since 2009, although very discreetly. The mega funds, and giant asset managing companies have been accumulating these assets feverishly, as they preached to the world that they are a scam.

Why?

Because they want to be in prior to you for one, before they tell you simply how wonderful these assets are, as they are doing now. So they flip flop as always, with everything and with all subjects until their positions are solidified or the fictitious narrative is complete. This present, short term correction is how those attempting to control the game end up owning all the gold, because people capitulate through fear and forget to look at the much larger picture and only focus on daily price action.

How do we know this is simply another short term correction?

The truth is nobody knows for sure in the short term due to black swan events and tragedies, real or the hoax variety of which the good people of this world possess little control over. Such misfortunes always cause fear to prevail throughout every marketplace. But the truth is also, that Web3 block chain technology is not ever going away, and it will in fact be at the forefront of how commerce is conducted by the vast majority of people in our worldwide society to say the least. This trustless on chain finance technology will be utilized interplanetary, perhaps it already is, and will soon be commonly referred to I surmise, as Galactic money.

What we do know for certain pertaining to my sentiments regarding this recent dowturn being just another healthy short term sell off is the following, and one might also consider these reference points before making any decisions out of haste or the worst, fear.

It is estimated by the World Bank, Expaam, and other technical analysis researchers that cryptocurrency and Web3 is being adopted at now twice the speed of the old internet.

Over 1 Billion users of the new Web3 by the year 2025 is what the data is implying.

As well as.

Several billion USDT (Tether) has been minted over the last few days, and over 754 million in USDC has also been printed by the United States Treasury during this same time. Historically, when this much minting is occuring within a few days the cryptocurrecy markets have risen exponentially in value as these “stablecoins”, even though there is nothing stable about Tether, are pegged to the US dollar. When money is being printed as such, markets go up, this is a fundamental rule. History shows us that every time the cryptocurrency markets sell off, the printing machines are engaged and then those funds are sent to the exchanges typically for a buying wave.

Also, according to many verifiable metrics the US dollar is plummeting in purchasing power, even the mainstream is claiming this number to be around a 25% reduction in this area. More reasonable minds though see this number to be more to be around 50%, or even much higher.

How do we know this?

Because almost everything I am personally purchasing simply to sustain human life has doubled in price over the last few years. And this is not going to stop unless and until block chain decentralized finance comes more to fruition, thankfully this is exactly what is occurring. The unnecessary middle men, bankster gangsters are being discarded, they are being forced to acquiesce to at least some form of decentralized finance. People are becoming custodians of their own assets and funds. And as the dollar continues to lose strength worldwide, the (BRICS), block chain digital assets will necessarily soar in value, because this is why it was created, to mitigate the effects of the dollars demise.

What I will also share with you at this point is, the ones with all the money in the world are coming for every last token of specific on chain technologies that are in existence. This is because they are deflationary assets, there cannot ever be minted more coins than is embedded within the initial code. In other words, there is a finite supply, not an infinite one that we see with paper money. This forces greater value because of rarity and demand.

The question is always asked “who is going to pay for all this inflation and debasement of our money? And the answer is those that hold dollar bills, as difficult as this is for me to write.

It was Voltaire in the 1700’s that penned,“Paper money eventually returns to its intrinsic value, zero.”

One other indicator that this is simply a short term sell off is that the Bitcoin (BTC) hash rate has tripled since the last all time high only a few weeks ago. The hash rate is indicitive of usage on a particular block chain. So usage has tripled yet the price is going down, this of course makes no sense and is not sustainable.

It is very clear to me that we are at the beginning stages of the most masssive bull run we have ever seen, or will ever see again. The entire system of finance is being systematically altered, and is being adhered to the worldwide honesty ledger known as the block chain. We are in an uptrend now, and have been for the last several months coming out of the bear market of the last three years. This is the four year cycle which has replicated itself now 3 times in the last 12 years.

This is a momentary shakeout is all, being 100% manipulated by those that are attempting to control this game, because it is not beneficial to the current debt based fiat enslavement system for you or I to have any type of wealth whatsoever. This would invite challengers of course. The poor are much more manageable than the rich. If the masses were wealthy, we would not need work in their life draining factories, nor, drive an hour to a job that is despised to pay for a car most cannot afford, and then drive an hour home to a space which we are indeed renting, because it is impossible to own even when the mortgage, (latin for death contract) has been paid in full, to a lender, whom used borrowed money itself then charged us interest, as well as taxes on those same funds. The largest of all rackets is right in front of us.

Yet there is so much to be gracious for and there is a way out.

The amount of money that is going to be made over the course of the next few years by those taking immediate action, and fully committing themselves to learning all they can about this financial reset will be far to difficult to even conceive for most people. Yet, this is a very accurate statement, because trillions of dollars will be flowing into this arena of block chain technology, which will of course require astronomical prices of certain assets to be useful to the institutions and world governments as intended.

The market capitalizations we now see on some of the largest projects in the world are currently valued in the low millions some of them, the larger ones in the billions, and of course we already have one digital asset that has reached one trillion dollars. My point is that Bitcoin (BTC) will not be the only one with a trillion dollar market cap, in fact there will be several. If one owns a piece of a chain technology with a market cap of say 30 million dollars which climbs to a billion, or even trillion with massive utilization and adoption, do you know what that would do to your investment profit wise? Indescribable would be a word that comes to mind.

Do not let them shake you out, these are professional deceivers that use trading bots and their unending supply of money to control price action. When in doubt it is said to zoom out, step back and look at the larger picture which by the way is extremely difficult in a left brain dominated society.

Cryto Adventure writes, If you had invested $4,000 to buy Amazon shares during the Internet dot com boom in 1997, by last year, that would have become worth some $7.3 million.

Another reassuring point that I have not heard anyone else communicating is that this time it is not going to take 12 years to make these types of gains as described above. I feel everyone can agree everything is moving much faster, and this includes profitablity and reward for efforts.

Is the world going more digital, the answer is yes.

Is the block chain being adopted by the largest entities in the world, the answer is yes, they even are now telling you so themselves.

Is block chain Web3 technology growing faster than the old internet, the answer is yes, at least at twice the speed.

Is anyone using already this technology, the answer is yes, over 1 billion people by the year 2025, so sayeth the World Bank.

The companies that we know as Google, Microsoft, IBM, Amazon, General Electric, Apple, Intel, etc, are simply renaming themselves and operating under a different nomenclature in the Web3 space, it is all the same organizations. So what I am saying is, would you invest in IBM for under a penny right now?

These connections have been made already by some truly remarkable people of this world. Altruistic human beings that are sharing knowledge and positioning themselves for financial freedom which will amount to more liberty and leisure for those whom capitialize on this incoming move, how glorious this will be.

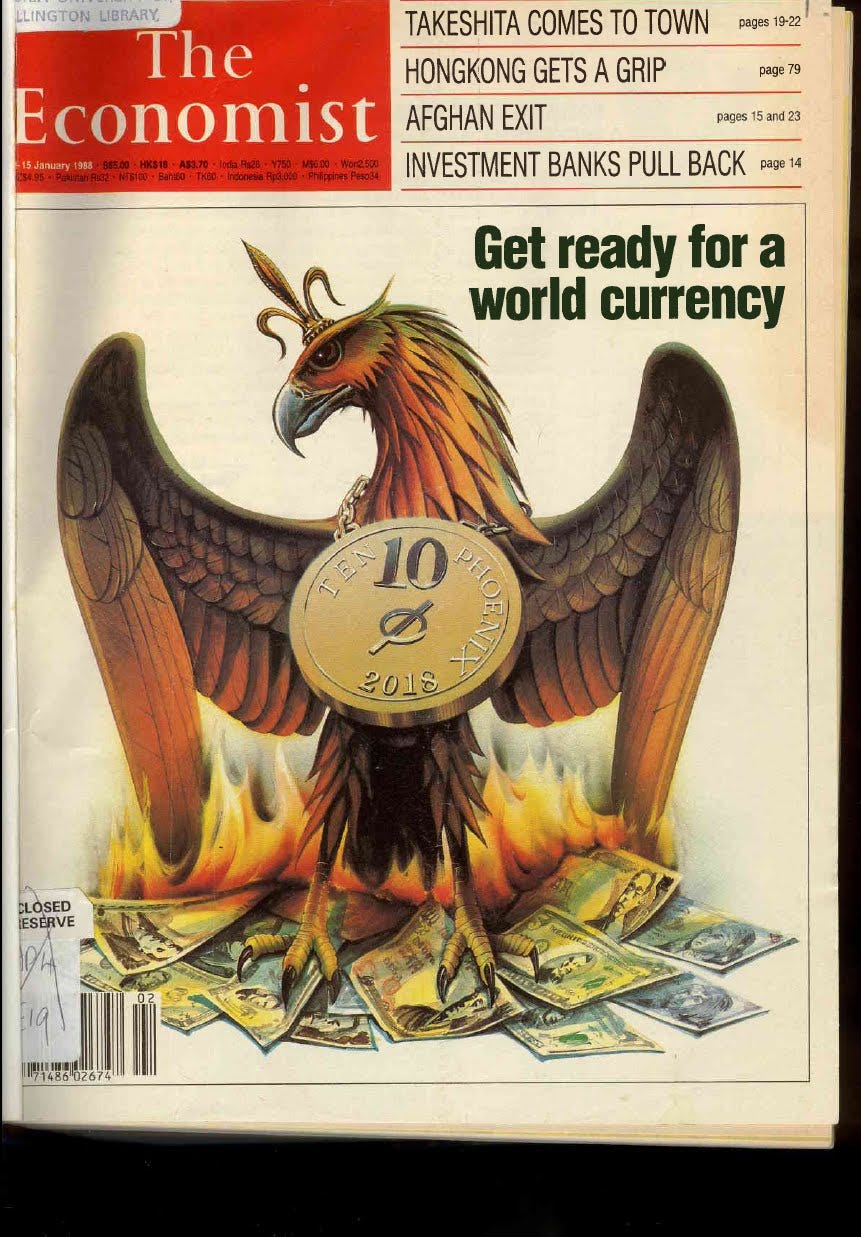

Notice the Rothschild’s owned Economist predictive programming magazine which printed in January of 1988. Observe the symbol in the middle on the phoenix chest. Now see the symbol for XLM/ Stellar below.

It is from the Confucian school of awareness where we remember the message, “signs and symbols rule the worlds, not words nor laws”

Know what you hold, as well as know who and what controls temporarily what you hold. This is not at all financial advice, as always conduct your own research with an open heart and mind.

Arete’ everyone may we all be blessed further in this life and in the next.

Ahimsa, Love, and Anarchy as without malevolent rulers.

Jessop Trust

References below that one will never appear on tel lie visions.